How Much Insurance I Personally Own as a Financial Advisor

Why I practice what I preach: Learn about the insurance I personally own as a CERTIFIED FINANCIAL PLANNER®.

Understanding the Overtime Tax Break and Senior Deduction in the One Big Beautiful Bill Act

The recently passed One Big Beautiful Bill Act brings meaningful tax changes to the federal level — and firefighters stand to benefit directly. Whether you're on shift or retired, two provisions of this new law are worth your attention because they are effective immediately for tax years 2025-2028.

Social Security Fairness Act and the Repeal of the Windfall Elimination Provision

The latest and greatest on the repeal of the Windfall Elimination Provision!

How To Retire With $1M As A Firefighter

Here’s a perfect example of how TIME IN THE MARKET > TIMING THE MARKET using the salary figures of an Indianapolis firefighter.

5-Year DROP Comparison

The Deferred Retirement Option Plan is an optional benefit that allows you to work and earn a salary while accumulating a retirement benefit payable in a lump sum.

Increased HELPS Act Flexibility

This law enables retired public safety officers (firefighters, as well as members of a rescue squad or ambulance) to pay for healthcare premiums by allowing the exclusion of up to $3,000 annually from gross income after separating from service as a result of disability or the attainment of normal retirement age.

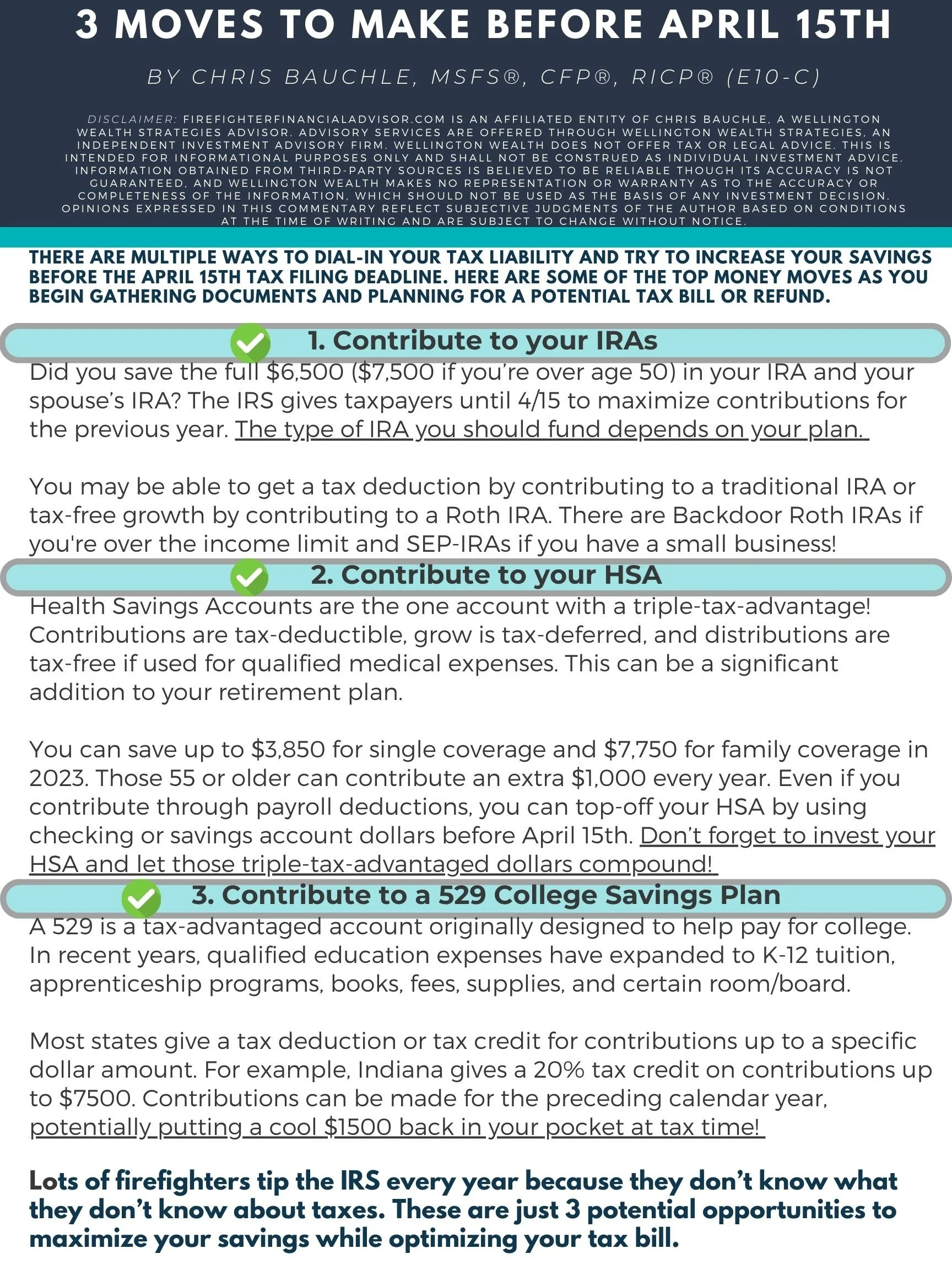

3 Moves To Make Before April 15th

There are numerous ways to dial-in your tax liability and try to increase your savings before the April 15th tax filing deadline! Here are some of the top money moves to make as you begin gathering documents and planning for a potential tax refund.

Timeline of Key Retirement Decisions for Firefighters

Between the ages of 50 and 75, firefighters make crucial, permanent decisions that can dramatically impact their lifestyle in retirement.

4 Financial Planning Steps Every Firefighter Should Follow

There are four financial planning steps every firefighter should follow and they should be followed in a specific order 99.9% of the time – just like on the fireground.

The 4% Rule

A foundational concept for answering the familiar question: “How much money do I need to retire?”

Charitable Giving and Other End-of-Year Reminders

Learn about our Firefighters On A Mission fundraiser and everything you need to know with a December 31st deadline.

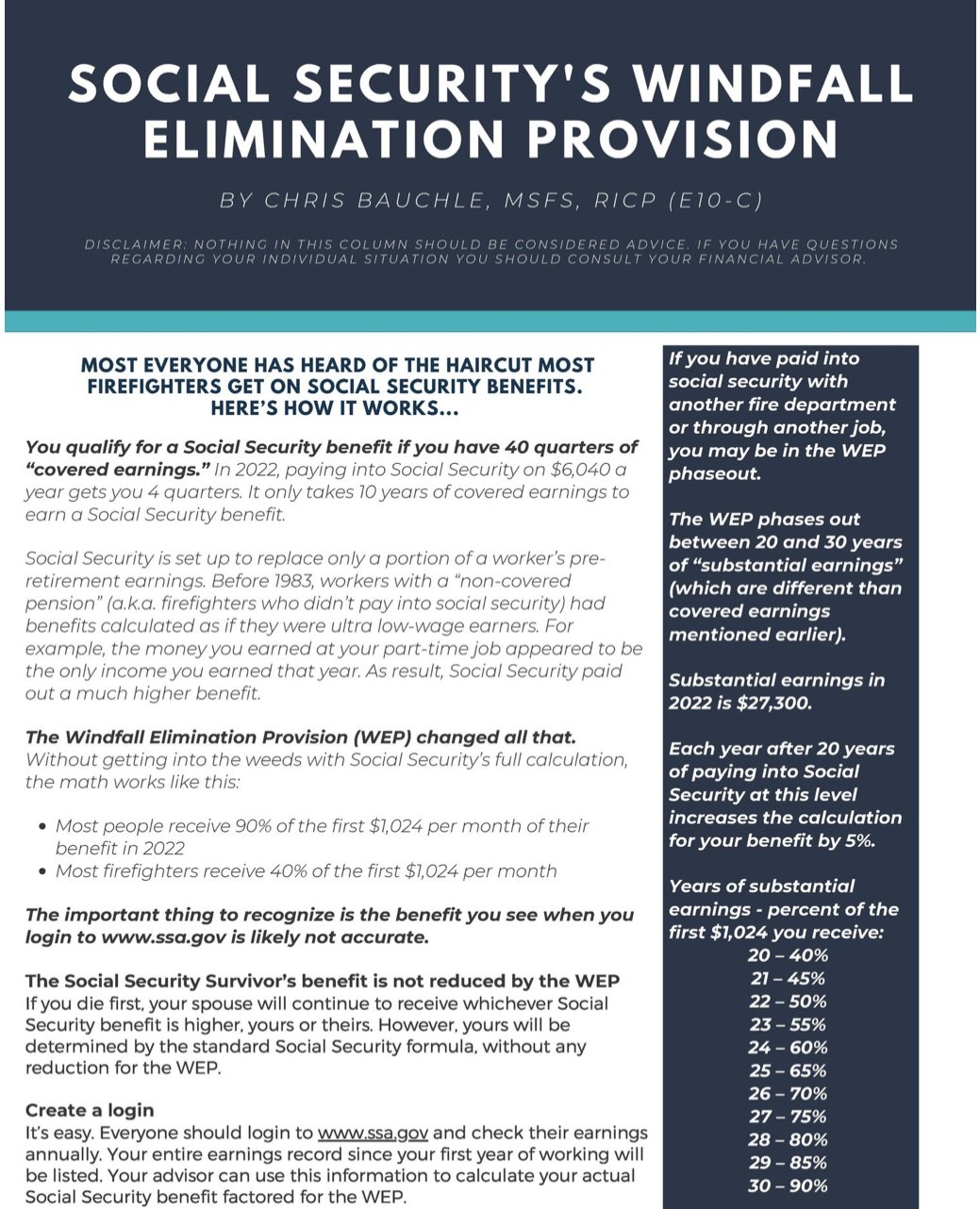

Social Security’s Windfall Elimination Provision and You

Understand how Social Security’s Windfall Elimination Provision affects most firefighters.

How to save 50% of a $120K income in 2022

If building wealth is a priority, flip the 50/30/20 rule on its head. This is what it means to pay yourself first.

Changes to Public Safety Loan Forgiveness

The Public Safety Loan Forgiveness (PSLF) Program forgives the remaining balance on Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time as a firefighter - and now you may temporarily get credit for payments you’ve made on loans that would not normally qualify.

The Power of Your HSA

The dollars in your Health Savings Account (HSA) are likely the most valuable dollars you own from a tax perspective.